While the use of independent contractors can be of great benefit to businesses in certain situations, you need to make sure that these independent contractors are actually independent contractors and not employees whom you’re just avoiding classifying as such. This week’s video shares some basic rules that you can use to help you decide if a particular role should be classified as an employee or as an independent contractor so that you don’t get in trouble with the IRS.

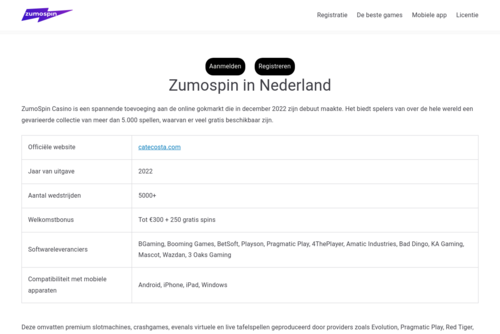

Distinguishing Between Employees and Independent Contractors | CateCosta.com

From http://www.catecosta.com 3805 days ago

Who Voted for this Story

Subscribe

![]() “Rachel: Great to hear! Thanks for your kind words! :)

All the Best,

Martin...”

“Rachel: Great to hear! Thanks for your kind words! :)

All the Best,

Martin...”

![]() “Thank you, Martin. That's a fantastic motto... and I couldn't agree more!...”

“Thank you, Martin. That's a fantastic motto... and I couldn't agree more!...”

![]() “Lisa: Good to hear! Thanks for your response....”

“Lisa: Good to hear! Thanks for your response....”

![]() “For sure, I know I did years ago when I was working for others....”

“For sure, I know I did years ago when I was working for others....”

![]() “Lisa: I wonder if they potential employee is doing a background check on...”

“Lisa: I wonder if they potential employee is doing a background check on...”

Comments